The Deceptive Allure of “More”

Chris Broome – Chartered Financial Planner

Cashflow is the lifeblood of any financial plan. How we allocate the money coming in will determine both the present and the future of our families. It’s not a glamorous topic, but it’s undeniably ground zero of financial success.

Our cashflow challenges evolve as we move through the different life phases. Our early working years are typically about providing for essential daily “needs”. For those whose careers allow them to break free from daily concerns, the allure of certain “wants” starts to emerge. These desires challenge our beliefs about what we need to be happy.

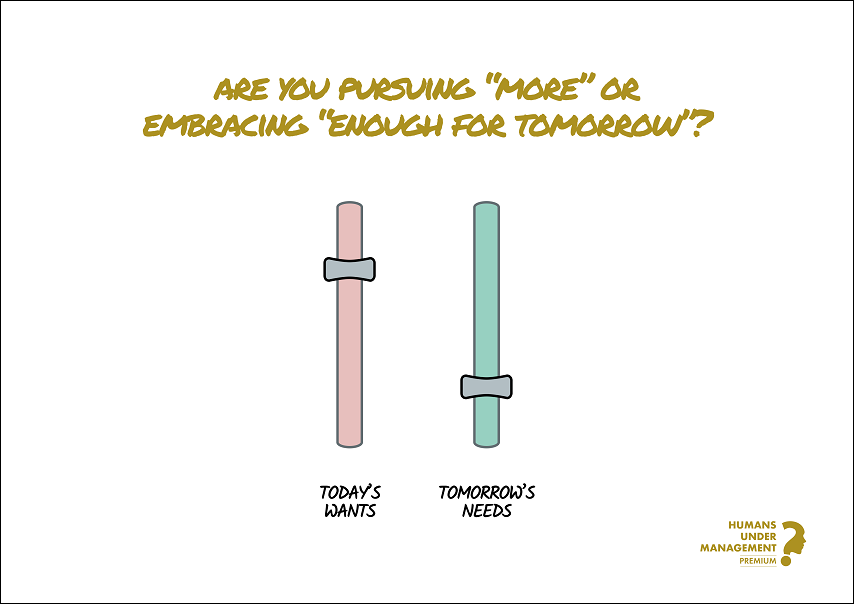

This internal battle rages on throughout life, and how we respond to this challenge will determine our future financial success. But what truly brings fulfilment, and what consequences do these decisions have for our future selves?

The Quicksand of Accumulation

Our desire to accumulate more is grounded in evolution. A striving for “more” drove past generations to create the world we now live in, and current-day economic theory is still based on the assumption that “more is better”. But, in a world where most of us have moved well beyond providing for basic needs, does this instinct for more create problems we could do without?

As financial advisers, we have witnessed firsthand families who have become ensnared by lifestyle creep at the expense of their futures. It’s a tradeoff many now regret, but like quicksand that gradually ensnares its victim, it’s difficult to break free.

Similarly, we have worked with many wealthy families who have found a way to overcome the desire for “shiny new things”. These families have a well-developed and personal philosophy of their values and a clear picture of what they consider a life well-lived.

Embracing The Tradeoff

There are many ways that spending can bring happiness and joy – interestingly, many of our clients have shifted their spending from possessions to experiences with family and loved ones.

However, everything in financial planning is a tradeoff. For many, embracing “more” comes at the expense of their own “tomorrow”. Tragically, this only becomes evident in most cases when it’s too late to change course.

Before all of us lies the invitation to let go of pursuing “more”, choosing instead to embrace “enough”. We appreciate and understand that everyone’s definition of satisfaction and “enough” is unique and personal. No matter what your definition of “enough” is, for most of us, this still means lives magnitudes better than our grandparents.

Navigating Together

We encourage you to seek clarity about what is truly important to you, bringing more intention to your spending and investing. All consumption cannot, and should not, be avoided. Indeed, one person’s “want” is another person’s “need”.

While you will always remain the expert in the design of your own life, we are the experts in guiding families in making the tradeoffs that provide them both meaning and an independent future.

Guiding families from pursuing “more” to embracing “enough for tomorrow” is our reason for being. The comprehensive planning we provide includes all the tools you need to walk your financial journey successfully. We look forward to guiding you on your journey to “enough”.

Next steps

If you have any questions about any of the above, or wish to discuss your long-term financial plans with us, please get in touch. Contact us