2 top reasons why you shouldn’t just follow exciting investment fads

Chris Broome – Chartered Financial Planner

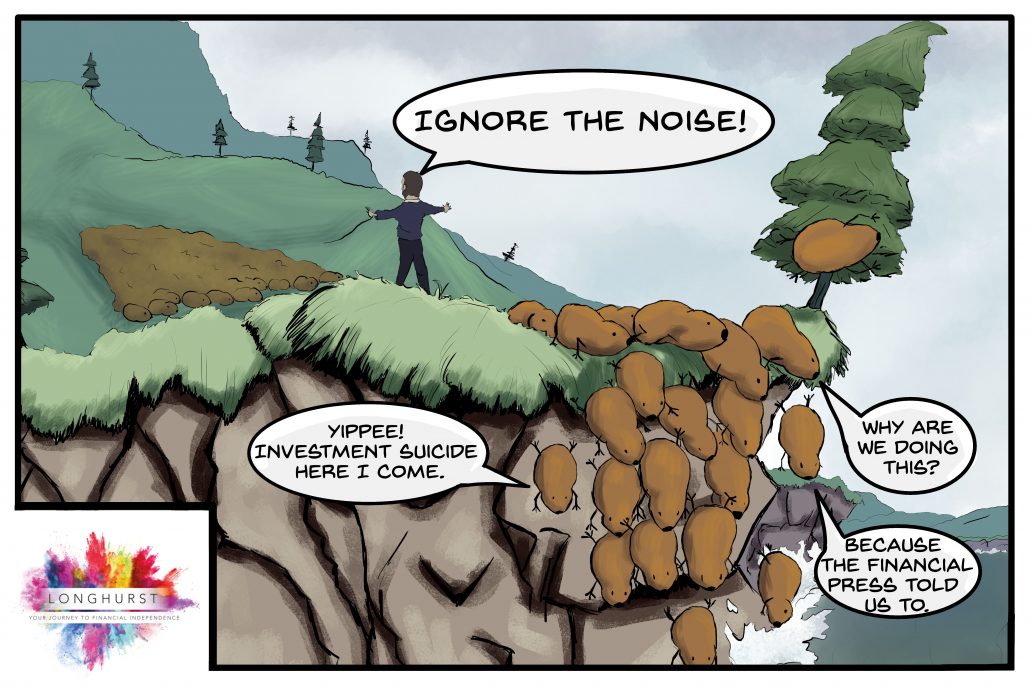

How many times have you heard or read about a particular stock that you should invest in? It can be tempting to follow exciting investment fads, but there are reasons why you shouldn’t.

From speaking to a friend that’s made a ‘good’ investment to reading the headline news, it can sometimes seem like you’ve missed an amazing opportunity by not piling all your investable assets into one particular company. It’s something we sometimes hear from clients too.

Microsoft, Apple, and even Bitcoin. What about NFTs?

The question I’m sure you ask yourself is this – why shouldn’t you just pile all your money into the next big thing?

Has the share price reached its peak?

Let’s take Tesla for example. In 2020 their shares have benefitted from astronomical growth, a particularly impressive feat given the pandemic meant many car companies, and other firms, struggled. Yet, that doesn’t mean it will replicate the same level of growth, or even grow at all, in 2021, let alone in the next ten years.

One of the golden principles of investing is that past performance isn’t a reliable indicator of future performance. It can be tempting to jump on an investment when it’s done incredibly well, but there’s no guarantee that you’ll benefit.

Consistently predicting market movements is impossible, numerous factors need to be considered and some influences can be unexpected, as Covid-19 highlighted last year. When you’re focusing on a single share, it’s even more difficult.

The difference in investor opinions highlights the challenges.

Backers of Tesla, dubbed Teslanaires, argue that the share prices will continue to rise as the firm pushes technology boundaries. However, critics note there is growing competition in the electric vehicle market, including from players with deep pockets, such as Apple.

Others say that Tesla shares are already overvalued. A research note from analysts at JP Morgan said: “Tesla shares are, in our view and by virtually every conventional metric, not only overvalued but dramatically so.”

So, who is right? Only time will tell but investing in stocks with the benefit of hindsight only can lead to a disappointing performance or selecting investments that don’t suit your goals and situation.

Sorting the ‘good’ from the ‘bad’

Another challenge to putting your money on a single stock is deciding which one to choose. For every good investment, there are dozens of firms that see a fall in their value and some that collapse. It could mean that you receive a far lower amount back than you invested or even nothing at all.

It’s the investment version of putting all your money on a single number at the roulette table, it’s a significant gamble.

When you hear about stocks that you should invest in, whether from colleagues or the media, it’s a suggestion that’s usually made with the benefit of hindsight. It’s far easier to say that something is a ‘good’ investment after a rise than sorting the ‘good’ from the ‘bad’ without this benefit.

Acting after a huge rise means you end up paying a higher price for the shares. Of course, it could rise further, but as mentioned above, there’s no guarantee.

So, how should you invest?

For most investors, an investment strategy should mean building up a well-balanced portfolio that contains a range of assets that reflects their risk profile.

Within this portfolio, you may choose to invest in the likes of Tesla, but it should be balanced with assets from a range of firms, industries, locations and more.

In this way, you’re not fully reliant on the performance of just one asset. The risk is spread across a range of assets, this helps to balance out the ups and downs of market movements.

Your goals and risk profile should be central to your investment decisions. For some investors, a conservative approach with an overall portfolio that is low-risk makes sense, for others, a higher-risk investment strategy is right for them.

Financial planning can help you understand where investments fit into your lifestyle and goals.

Want more to read?

Check out our wisdom page called ‘The Next Big Thing‘ for more information.

Get in touch

Please contact us to discuss your investments, building a portfolio and how they can help you achieve your aspirations.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.