Meetings & Advice Areas

Where are meetings held?

All meetings are either held at our offices in Kingham (Cotswolds), Silverstone (Northamptonshire) or Farringdon (London), or virtually via secure video conferencing.

Should your personal circumstances necessitate a meeting at your home or workplace please contact us to discuss your requirements.

Do you have parking at your office?

Cotswolds – Yes. There is ample free parking at the office.

Silverstone – Yes. There is ample free parking at the office.

London – No. The nearest tube station is Farringdon.

What financial product & advice areas do you cover?

We hold permissions for, and provide planning services, covering:

- Pensions

- Investments

- Wealth Management

- Retirement Planning

- Tax Planning*

- Inheritance Tax* & Estate Planning

- Human Insurances (Disaster Planning)

- Mortgages

- Equity Release

- Later-Life Advice & Care Fee Planning

- Behavioural Coaching

- Corporate Advice – Workplace Pensions & Employee Benefits

* Tax treatment is based on individual circumstances and may be subject to change in the future.

The Financial Conduct Authority does not regulate tax planning and workplace pensions.

The Pensions Regulator is the statutory regulator for workplace pensions.

Fees and Costs

How do you charge?

Initial Meeting

We offer all new clients an Exploration Meeting which is held at our expense and without obligation.

This meeting provides us with an opportunity to discuss your situation, your planning needs, life planning goals, and your time horizons.

Following this meeting we will write to you with a personalised proposal confirming the services we will provide to you and the associated fees.

Initial Financial Planning Review, Regulated Advice and Strategy

We will comprehensively assess your current financial circumstances and establish how your existing resources can be expected to support your desired lifestyle in the long term.

We will then discuss our findings with you and document the financial planning strategies that you should consider.

Incorporating detailed lifetime cash-flow forecasting, the review will compare:

- Life as it stands today, and whether your current portfolio of assets (and how they are currently invested) will support your short, medium, and long-term goals.

- A number of bespoke What-If scenarios comparing the anticipated outcomes of different financial planning strategies.

- Stress-testing all options by looking at investment volatility and what problems you may face in the event of a market downturn at different stages of your life.

We’ll then provide you with regulated independent financial advice regarding which products, product providers, and investment strategies are most appropriate to enable you to secure and maintain your financial objectives.

This covers personal pensions, investments, and savings, as well as covering arranging lump sum investments, new regular contributions, and withdrawals from an existing investment/ pension arrangement.

Our initial fee starts from £2,000 and is capped at £5,500. The fee is always confirmed in writing to you before any work commences.

Implementation of Advice

Once we have made the recommendations, the Longhurst team will then get to work implementing them on your behalf.

This will include:

- Managing all of the paperwork and administration.

- Preparing your new product and platform account application forms.

- Managing all pension/investment transfer applications.

- Liaising with your historic product providers.

- Creating and then deploying your new investment portfolio.

- If relevant, ensuring your new income is switched on as soon as possible.

- Working alongside any other professional partners you may have.

- Confirming what historical paperwork you can recycle and remove from your home filing cabinet.

- Holding a post implementation meeting to ensure all aspects of the advice work have been completed, then discuss next steps.

- An implementation stage which can typically take anywhere from 3 to 12 months to fully complete (subject to the size and complexity of the estate).

For implementing our recommendations, we charge a fee of 1% of the amount you invest through Longhurst, with a minimum fee of £1,000 and capped at a maximum of £10,000.

Switching adviser into Longhurst

If it becomes clear that we are purely taking over the advisory relationship, and not recommending a change to your existing product and platform provider(s), we will take a view on how we charge and agree this with you ahead of proceeding.

Ongoing Support

If you want to achieve and maintain your version of Financial Independence, be tax-efficient, and leave a meaningful legacy for your loved ones, it will require constant work and adjustment.

We therefore offer an ongoing Annual Forward Planning service, catering for you no matter what life and wealth stage you’re at.

We split the services offered down into two clear elements: (1) Financial Planning and (2) Investment Administration.

And, we provide additional support services if you own and run a business.

(1) The financial planning fee for this service starts from £300 per month or £3,600 per annum.

(2) The investment administration fee for this service is 0.3% per annum of funds under management, covering all areas of investment advice, management, and administration.

There will also be fees payable to the recommended Platform / Custodian, and the underlying investment funds (see example below).

How do I pay?

We can facilitate our fees through you directly, through your investments, or through your Limited Company.

Our charging principles

We charge fees based on the value we’ve created for you, your household, and your business.

We do not compete on fees, or on ‘track record’, or any other variable. We encourage all prospective clients to choose a financial planner in whom they feel the most implicit trust. It’s a personal decision, and one only you can make yourself.

You can easily find advisers who do less – and who care a whole lot less – than we. They probably also cost less. We think you have to ask yourself if that’s what you really want.

Whilst we are certainly not the cheapest adviser on the market, we are definitely not the most expensive. Our fee model is fair and reflects a mutual respect where no conflict of interest will exist between you and us.

We know that our full suite of services encompasses every element of your financial journey. Are you receiving this level of support from your current adviser.

Fee Example

A married couple in their 50’s are introduced to us by their solicitor. Their children have flown the nest, and as such they are now focused on putting enough away for their well-earned retirement.

They are employed, with Mr an additional rate tax payer, and are both contributing into their workplace pensions. They have significant savings spread across 5 Personal Pension Plans and ISAs.

They would like to make sure they have a robust retirement plan in place; want to maximise tax efficiency; and want to improve on their current bank saving rates. Their investable estate is currently worth a combined £1,000,000.

Initial Planning, Advice and Implementation

Our initial fees would be as follows:

- Initial financial planning review @ £2,000

- Advice & Recommendation across 5 policies @ £2,500 (5 x £500)

- Implementation service, assuming advice is to consolidate all 5 policies together @ £10,000 (£1m*1% – capped)

- Total cost, if this client implemented our advice = £14,500 (equivalent cost of 1.45% of investable assets)

Industry Average

Research by the FCA in 2016 and 2017 identified that the average Initial Financial Planning Fee ranged from 1% to 3% of the amount invested (each year).

A median charge 2%.

We’re aware of several wealth managers charging initial fees of up 5% – including a very well known restricted advice firm.

Annual Forward Planning

The on-going forward planning fees would be as follows:

- Financial Planning flat fee @ £3,600 per annum

- Investment Management fee @ £3,000 (0.3%)

- Platform / Custodian fee @ £2,700 (0.27%)

- Underlying Financial Instruments fee @ £3,000 (0.30%)

- Total annual fee @ £12,300 (equivalent cost of 1.23% per annum of funds under management)

Industry Average

Research by the FCA in 2016 and 2017 identified that the average Annual Ongoing Charge ranged from 1.85% to 2.40%.

A median charge 2.13%.

Due to our flat-fee proposition, the larger the investable estate, the more cost-effective our proposition looks compared to traditional high-street advisers and wealth managers.

Regulation & Security

Are you truly Independent?

Yes.

Longhurst Limited is privately owned, meaning we are not influenced by a parent company.

We are also Independent Financial Advisers, meaning we have access to the entire market place of financial and investment solutions.

Are you regulated by the Financial Conduct Authority (FCA)?

Is my money safe?

We do not hold any client money so there is no trading risk associated if you choose to work with Longhurst.

Investing your hard-earned money of course carries a degree of risk. Daily valuation fluctuations are common place, and as the risk warnings state: You may get back less than you invested.

We complete a comprehensive risk profiling questionnaire with each client we work with, which alongside other factors helps steer the advice we give you.

Any money you invest is held in a nominee account with one of the UK’s leading investment platforms. This protects your assets in the unlikely event of the investment platform failing.

Your investments are also covered by the Financial Services Compensation Scheme (www.fscs.org.uk).

What if I‘m not happy with the advice I’m given?

Our ‘Initial Financial Planning Review’ service comes with a guarantee that if you’re genuinely not 100% happy with our work we’ll refund you 100% of the fee you’ve paid.

For existing clients, if you’re ever unhappy with our advice, or any other element of the relationship, please let us know immediately so that we can resolve the situation as quickly and as pragmatically as possible.

If you’re still not happy, you can then contact the Financial Ombudsman Service (www.financial-ombudsman.org.uk).

What should I do if I get a withheld and suspicious call from Longhurst?

You should call us directly on 01327 223243.

We will never cold call you or send an email without having had previous permission.

The Longhurst team will always help you with any checks.

What Sets You Apart?

Why is working with a Chartered Financial Planner important?

Every client of Longhurst gains access to a Chartered Financial Planner and a Fellow of the Personal Financial Society.

Chartered Financial Planner status is regulated by the Chartered Insurance Institute (CII) and is granted by the Privy Council. It is our profession’s gold standard for financial planners. It is a commitment to an overall standard of customer excellence and professionalism.

This means your financial planner will have over 20 exams and completed well in excess of 2,000 academic study hours.

By engaging with Longhurst you will be working alongside some of the highest qualified and ethically proven financial planners in the country.

Why is working with a Gold Standard Pension Transfer Specialist important?

We have signed up to the Personal Finance Society’s ‘Pension Transfer Gold Standard’.

We have signed up to the Personal Finance Society’s ‘Pension Transfer Gold Standard’.

The PFS is the professional body for the financial planning profession in the UK. Their remit is to lead the financial planning community towards higher levels of professionalism exhibited through technical knowledge, client service and ethical practice.

In practical terms this is an adviser code of conduct that helps clients understand when advice is appropriate and ensures that if it is it supports their overall wellbeing in keeping with their stated objectives. It also ensures that clients understand and accept all the charges and costs associated with transferring their benefits and avoids conflicts of interest.

The Gold Standard embodies the culture of advisers who are passionate about their profession and dedicated to achieving the best possible outcomes for their clients.

Clients who are considering transferring their pension benefits will be provided with a copy of the ‘Pension Transfer Gold Standard Consumer Guide’ at the point when they confirm that this is one of their objectives.

What is a Fiduciary Financial Planner?

We only give advice, and produce a bespoke financial plan, if we have followed a comprehensive research process.

We will never steer you into an investment or product which will benefit us more than it will you.

We will ensure your life savings are invested with the same level of importance that we invest our own family’s life savings; treating your capital as a hard-earned asset requiring careful attention.

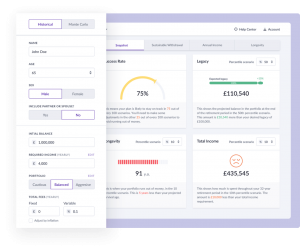

What is Voyant?

Voyant helps advisers and clients plan and adapt to real life events, before, during and after they happen. It’s interactive, easy to use, and collaborative, meaning advisers and clients can work together to make smarter, more tangible financial decisions.

From retirement planning to buying a new home, Voyant’s interactive planning tools help users visualise their financial future, test different scenarios and instantly understand the impact of key decisions on life events along the way.

With Voyant, you get all the information you need to answer every “what-if” scenario.

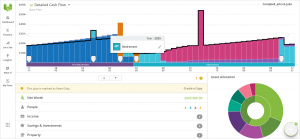

What is Timeline?

Timeline provides us with the ability to stress test a client’s pension income pot against actual, severe market falls (like the Financial Crisis or even the 1973-74 Crash).

It transforms extensive, empirical asset class and longevity data into a visually dynamic, easy-to-understand story for clients. Your story. It:

- Demonstrates the impact of asset allocation, rebalancing, glidepaths, fees, and taxes

- Uses interactive fire-drills to prepare you for market declines

- Illustrates longevity risk and show you the probability of outliving their portfolio

- Crafts a personalised withdrawal policy statement for you within minutes

Timeline runs 1,000 scenarios for a 30-year retirement plan. Each scenario has 30 different annual returns (in fact, they use monthly data, so each scenario has 30 * 12 monthly growth and inflation rates).

The benefit of this is that they can test the impact of various real-world scenarios, such as the 72/73 bear market when UK equity declined by 67% and took nearly six years to recover fully. Or, the Great Depression when US equity declined c87% and lasted over three years.

Using this extensive data allows Timeline to stress-test the impact of these scenarios of every single year of our client’s retirement plan