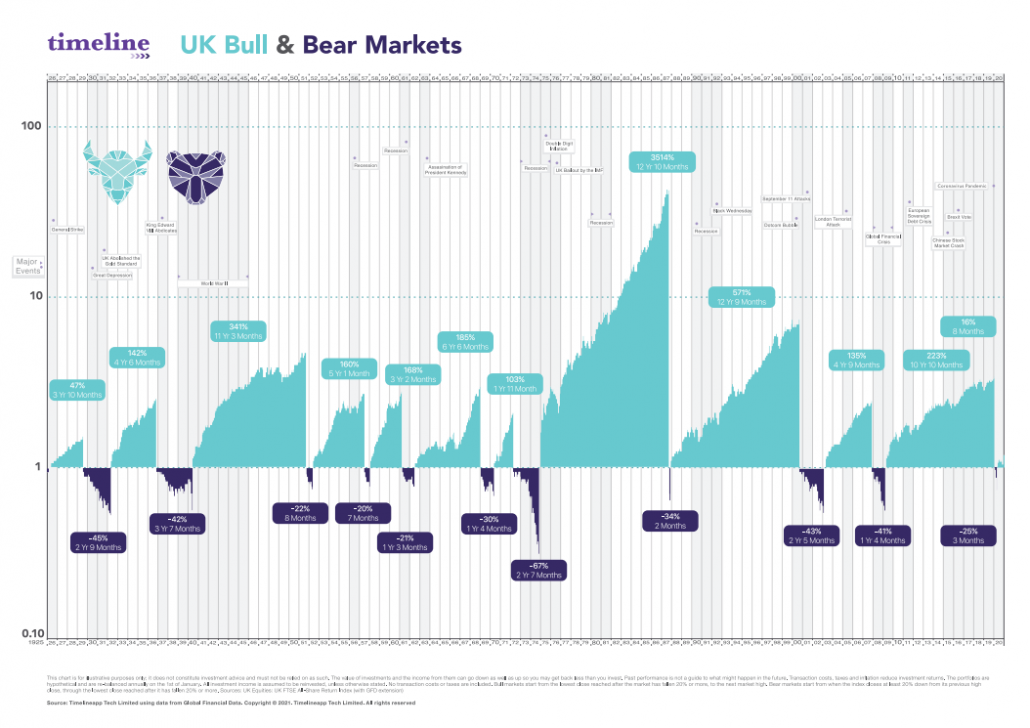

Our Bear Market Statement

- A 20% market fall is known as a bear market;

- We have been here before, many times in fact, and if history is a good guide we will be here again, an average of one year in every six;

- Neither the Longhurst team, nor anyone else, can predict when, where or why a bear market will bottom out;

- But be assured that from a historical perspective it will bottom;

- History teaches us that it has always been a mistake for a long-term, goal-focused investor to sell their portfolio when it seems everyone else is doing the same (herding);

- However, the general rule of thumb is this: if your goals haven’t changed, and your portfolio is historically appropriate to those goals, then don’t change the portfolio in reaction to current events;

- As powerful as the urge is to get out of the markets, and as reasonable as it will seem at the time, it is as close to a promise of below average returns at best, and of the destruction of your whole retirement plan at worst, as one can get;

- If you succumb to the herd, and change your portfolio during these moments, it may turn out to be the biggest financial mistake you ever make;

- If your goals haven’t changed, don’t change your portfolio;

- We will always be here for you.

The stock market is like someone playing with a yo-yo while riding on the up escalator.

You need to focus on the escalator not the yo-yo.

Image courtesy of Timeline, financial planning software we license for our clients.

THE VALUE OF INVESTMENTS AND THE INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.