Family Investment Company

Chris Broome – Chartered Financial Planner

You’ve just sold your business for £10,000,000. Congratulations!

A lifetime of starting and then growing your business. Decades of high pressure and, at times, risk taking. You’ve exited successfully, job done.

You are now facing the very real reality that this new found wealth needs to be protected.

You want to ensure your estate remains tax efficient.

And you want to make sure those you love benefit, over time, and with due care.

In the past, trusts were always the traditional way to pass down family wealth to future generations. However, in recent times, and with favourable tax changes, a Family Investment Company (FIC) may now offer a more efficient option.

The Finance Act 2006 introduced significant changes to the UK’s tax regime for family trusts. Most new family trusts now enter into the “Relevant Property Regime” which result in:

- An immediate charge to IHT at 20% for transfers made in excess of a donor’s available nil rate band (currently £325,000).

- Ten year IHT anniversary charges (capped at a rate of 6%).

- Further charge to IHT if assets “exit” the trust, also capped as above.

With these limitations, individuals wishing to pass down substantial wealth need to consider alternative vehicles which may be more efficient.

This is particularly topical due to the increasingly competitive rates of corporation tax available in the UK (currently 19% at date of writing) and whether it is possible to use a company as a store for family wealth, and a vehicle to pass it down the bloodline.

What is a Family Investment Company?

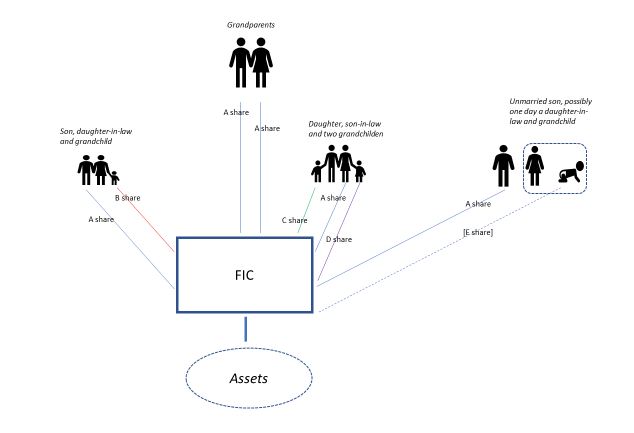

A Family Investment Company (FIC) is a private limited (or unlimited) company, whose shareholders are different generations of family members.

A FIC enables parents to retain control over assets whilst accumulating wealth in a tax efficient manner, whilst also facilitating future succession planning.

This vehicle can be extremely efficient where an individual transfers significant sums of cash or other assets into the company.

The cash or assets could be invested to generate wealth and income for the family.

FIC Structure

- The parents provide significant funds to the FIC in the form of either interest-free loans or by subscribing for preference shares. This will not be regarded as a transfer of value for inheritance tax (IHT) purposes and these funds can be extracted from the company at a later date tax-free.

- The parents also subscribe for voting shares in the FIC, which give control of the company at shareholder and board level.

- The parents could also subscribe for a class (or classes) of non-voting shares. The parents can then choose to give non-voting shares to their children (preferably before significant value accrues to those shares). The gift will not be subject to IHT, provided the parents survive for seven years from the date of the gift. The non-voting shares may pay dividends in future.

- The parents could also put funds into a discretionary trust for the benefit of their minor children without triggering an IHT charge, to the extent that their IHT nil rate bands and annual exemptions are available (maximum £662,000). The parents should be irrevocably excluded from benefiting from this trust. The trustees then subscribe for a class of non-voting shares in the FIC at market value, ie at nominal value if the company is being newly created.

The Benefits of a Family Investment Company

(1) Asset protection

The FIC’s articles of association can include a provision to prevent any share transfers to members’ spouses. In the unfortunate event of a divorce, the court will likely be reluctant to order a transfer of shares that is not permitted by the company’s AoA.

This protection can be enhanced even further by the family members holding their shares via nominees.

(2) Retaining control

The FIC founder(s) controls the appointment of directors.

The FIC’s directors retain full control over the investments within.

The directors can also decide which of the family shareholders are allowed to dividends.

Alternatively, the directors may choose not to declare any dividends and allow funds to roll up and grow within the company or reinvest them.

No shareholder has a right to automatically receive either income or capital from the Family Investment Company.

(3) Inheritance Tax

The good news is that there are no lifetime inheritance tax charges arising on transferring sums to the FIC, irrespective of the value transferred. This makes a FIC incredibly attractive compared to trusts which have a 20% entry charge for amounts transferred above the nil rate band (£325,000).

To allow you to keep control over the assets in the company, you can be named as a director and be a preferential shareholder, so you have all the voting rights but no rights to the capital. If you adopt that approach, as long as you keep no beneficial interest in the company, then after seven years the value of the money or property transferred will fall outside of your estate for inheritance tax purposes.

Unlike trusts, FIC’s do not face an inheritance tax charge every ten years. The value of the shares held by a family member would be taxable in the event of his/her death, although the value of the shares will generally be lower than the value of the underlying investments.

(4) Corporation and Income Tax

The current rates of corporation tax at which any income and capital gains are taxed within the FIC are significantly lower than the top rates of income tax and capital gains tax payable when assets are held in trust or held directly by family members.

In particular, where the FIC holds shares, dividends paid on these are not taxed within the Family Investment Company.

If the profits are to be retained within the company no further tax would be payable but there will be further potential tax charges on any distribution of income or capital to the shareholders.

There is therefore an element of double taxation which can reduce the overall tax benefits, but there remains a far greater degree of control over the occurrence and timing of tax charges upon the individual family members.

(5) Privacy

If the company is set up as a limited company, it is necessary to file annual accounts with Companies House. To maintain confidentiality, the Family Investment Company can be set up as an unlimited company for which there would be no requirement to submit annual accounts.

(6) Management expenses

Expenses incurred by the company in managing its investments and running its business will be eligible for corporation tax relief. This will include investment managers’ fees and remuneration paid to employees/directors. Certain items are not eligible for tax relief, such as entertaining.

By contrast, an individual investor cannot obtain tax relief on the expenses of managing his share portfolio.

(7) Utilisation of tax relief on interest and management expenses

The company will be able to offset items against its taxable income – eg interest receivable and taxable dividends (ie dividends not exempt) – and capital gains.

Any excess amount can be carried forward and offset against the company’s future taxable profits from its investment business.

Trusted Team Approach

We will collaborate with your existing legal and tax partners, or refer to ours, whereby we’d then deliver the following team service:

The tax team will help you to structure the FIC tax efficiently, prepare its financial reports, and cover all key considerations, like ongoing tax compliance or the implications of transferring assets.

The legal team will ensure the financial reporting is compliant and properly implemented, whilst also overseeing the FIC incorporation and the drafting and reviewing key legal documents, including articles of association and shareholders agreements.

Finally, Longhurst will help you to align the FIC with your wider multi-generational financial planning, ensure risk is carefully managed, carefully structure your investments, and help you to focus on living out your ideal lifestyle and legacy.

In Summary

A Family Investment Company is something that should be considered as an alternative to a trust for asset values exceeding the nil rate band.

A FIC still allows the donor to retain control over their investments whilst avoiding an immediate charge to IHT.

Formal tax and legal advice will be required ahead of the creation of a FIC. Longhurst will introduce you to one of our recommended FIC partners, where we would all work in collaboration to first set up, and then manage ongoing, your new FIC.

Please get in touch if you have any questions or would like to discuss your family wealth.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.