Think you can time the Market?

Chris Broome – Chartered Financial Planner

When we meet a new household one of the many conversations that we have surrounds the Longhurst approach to investing their hard-earned capital.

We hold many beliefs in their area, but one of the main ones is that Markets cannot be timed, both when to get out, and when to get back in.

The Market’s pricing power works against mutual fund managers, who try to outperform through stock picking and Market timing. As evidence, only 23% of US equity mutual funds and 8% of fixed income funds have survived and outperformed their benchmarks over the past 20 years.

Think you could do better?

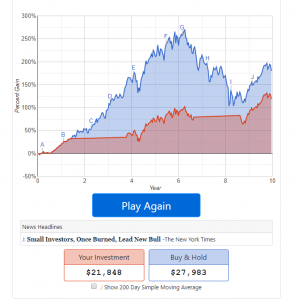

We recently found a fantastic Market timing game through a US based website. Here, you get to play as fund manager, attempting to beat the Market return. Bravo to the team at the Personal Finance Club for building it.

Are stocks due for a crash?

Is it a good time to buy low?

Can you time and beat the Market?!

How did you do?

It’s a lot harder then you think, isn’t it?

If highly qualified ‘star’ fund managers can’t consistently do it, why on earth would we try to?

At Longhurst we take a different approach to investing our clients hard earned capital. One that removes the focus away from attempting to pick the winning stocks or trying to time the Markets.

Click here to download our Investment Principles Guide.

For more information, or for a general chat about your own personal planning, please contact us at hello@longhurst.co.uk

THE VALUE OF INVESTMENTS AND THE INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.